A very quick post for any and all that are currently with the Commonwealth Bank (with loans that started before 1st July 2011) and wanting to change banks. If you’re not with them (or are and don’t want to change) then you can stop reading this now and move along.

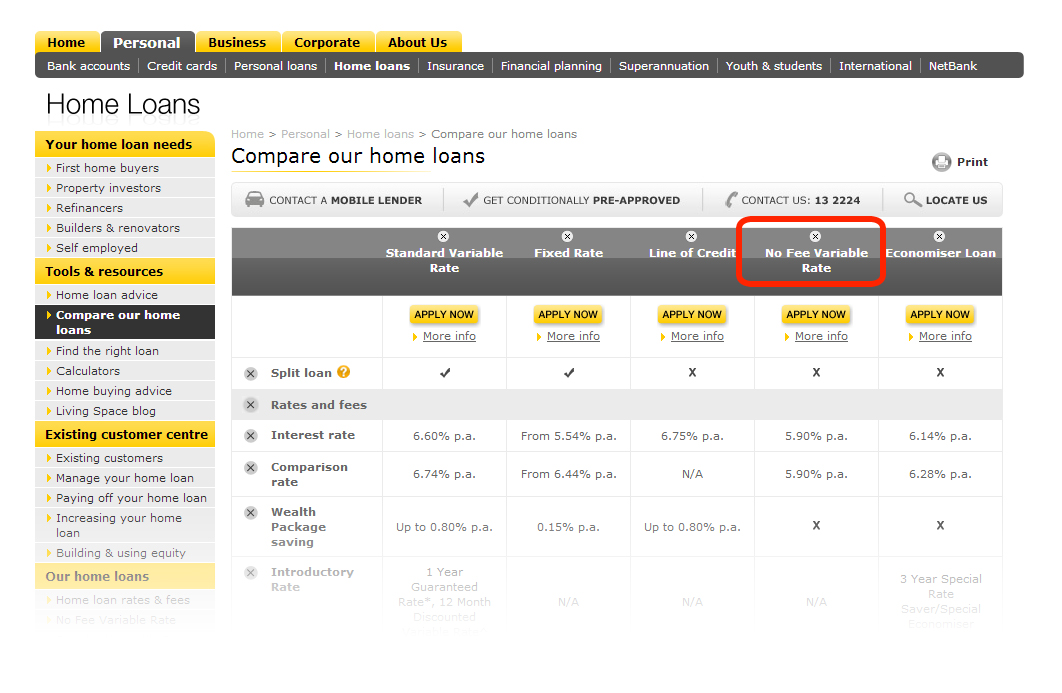

If you take out a new mortgage now or took yours out after July 1 2011, then you should by law have no exit fees. Currently though, there are a myriad of fees that you might have to pay to move your pre 1st of July 2011 mortgage from one bank to another (some of the main ones are listed below), however through some deep investigations I’ve learnt of a quick little trick you can do to get rid of at least some of the fees Commonwealth Bank charges its customers when they switch. As of writing this, the Commonwealth currently has a recently updated loan type called a “No Fee Variable Rate Home Loan”. You can get more information on it here but the main point about it obviously, is that it has no fees. As it has no fees, there’s no Settlement Fee or Discharge Of Mortgage Fee, two things that are commonly on other types of Commonwealth Home Loans entered into to before the “no exit fee’s law” came into act last year. As it is also just another product type to Commonwealth, it’s free to switch your home loan over to it making this little trick very simple.

If you want to change banks but the Commonwealth Bank is going to charge you exit fees, simply switch to the “No Fee Variable Rate Home Loan” first… wait a day or two and then switch banks! As you’re now on the “No Fee” home loan those existing exit fees you would have had to pay will no longer exist! Instant savings! Depending on what exit fees your loan has on it, this could save you anywhere from $350 up and all it takes is a phone call to 13 22 24 and a few minutes of your time.

An Example Of Charges When Switching Banks

| Who Charges The Fee: | Fee Name: | Amount: |

| New Bank: | Security Admin Fee: | $195.00 |

| New Bank: | Establishment Fee: | $600.00 |

| New Bank: | House Valuation Fee: | $200.00 |

| Land Titles Office (Government): | Discharge Of Mortgage Fee: | $105.00 |

| Land Titles Office (Government): | New Mortgage Fee: | $105.00 |

| Commonwealth Bank: | Deferred Establishment Fee: | $175.00 |

| Commonwealth Bank: | Settlement Fee: | $350.00 |

As you can see, the ones highlighted in bold can be set to $0 using this neat little trick. If you have more exit fees, there’s also a good chance that they will get waived too if they’re on the list mentioned in the quick Facts Sheet. That said though, this No Fee Variable Rate Home Loan is currently carrying a 5.90% interest rate which is quite highly competitive given there are no other fees, setup costs, annual charges, account fees and so on. It also allows unlimited extra payments so you can mutilate your mortgage and also has free Redraw facilities so there’s no need for an Offset Account.

Note: I’d also like to just note I am not affiliated with Commonwealth Bank in any way aside from using their services.

The benefits include: 1) How to pay off your mortgage faster than 99% of people with one hour a month of work 2) How to get rid of your debt and have the freedom to spend money on the things you love, guilt free 3) Clear outline of how to setup your expenses, mortgage and general finance 4) How offset accounts work and how to get the same result without being gouged by the big banks 5) How to cut through the crap and focus on the things that truly matter when taking down a mortgage 6) How to adjust the strategy so it works for you, even if you have kids, even if you only have one income 7) How to do all of these things and maintain a normal social life (and never be cheap).