Finances should be simple. It should be quick and easy to make sure you’re doing the best thing possible for you and your families financial future and that especially includes making extra mortgage payments. The secret to getting this result is automation, so let’s go into why it’s important and how to set it up.

Table of Contents

Why Automation Is Important

We have limited willpower.

“Trying harder” or whatever inspirational spin you want to put on it has officially been debunked by science decades ago I’m afraid. Time and again it’s been proven that we as humans suffer from a thing called Ego Depletion.

Simply put it means that once we resist something such as eating chocolate or buying a shiny toy vs Paying Off Your Mortgage Faster, it’s more exhausting to do it again later. Trying harder is irrelevant and futile. At some point you’re not going to have enough “strength” or willpower to resist and just go “stuff it!” and buy that car or new dress instead.

This is why ensuring you have automatic, extra mortgage payments setup is so crucially important.

Without the extra repayments being consistent and automatic, it’s far too easy and tempting to send that money elsewhere. Even if you’re one of the better ones and only spend it every few weeks or months, you’re still putting yourself through unneeded grief and hardship every pay day when you use your limited willpower to not buy that toy and instead pay down your mortgage.

Ensuring you have a high, automatic extra mortgage payments setup is the core way to pay off your mortgage quickly and easily. It’s completely different to what most banks or lenders suggest, which is usually “change from monthly to weekly repayments” or “have an offset account”.

This is because they are biased and want you to take as long as possible to pay off your mortgage so they make the most amount of interest off you. Getting finance advice from a bank is like asking an alcoholic whether you should drink more or not.

Automated, extra mortgage payments are also not a “tip” or “life hack”. Everyone loves reading endlessly about life hacks or getting something for nothing… but few truly get past this mental candy and put in the real work. The work of making large, consistent repayments to ensure your mortgage goes down over time. Thankfully, with automation this work is much easier!

Calculating Your Extra Repayments

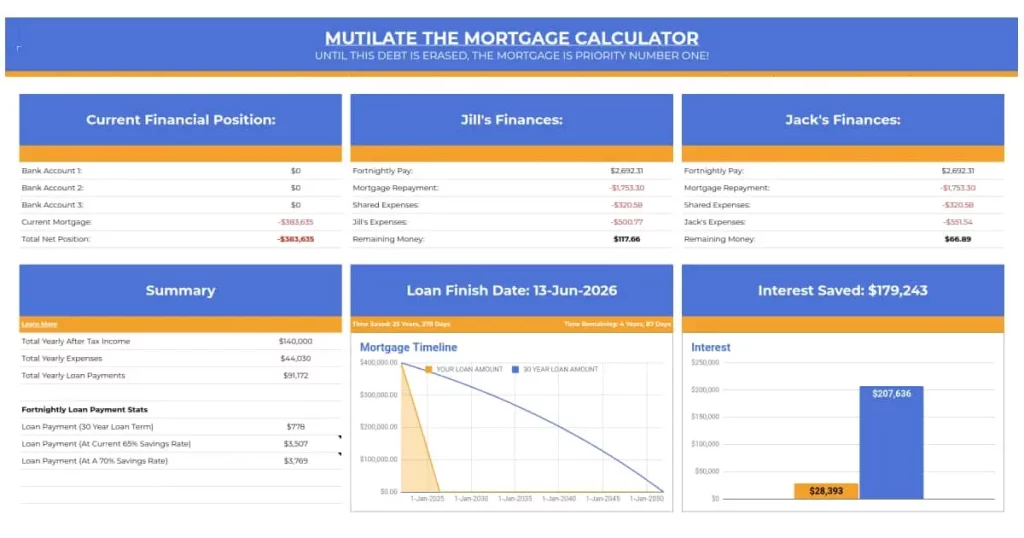

Before you setup your extra mortgage payments you first need to figure out How Much Extra You Should Pay On Your Mortgage. While this might sound like it’s hard to figure out, we have a purpose built Excel Mortgage Calculator Spreadsheet that will walk you through it step-by-step. Once you’ve got your number calculated for you, we can get into how to set it all up.

Setting Up Automatic, Extra Mortgage Payments

While it can be quite complex to setup other automated things like smart homes, setting up automatic, extra mortgage payments is simple and only takes a few clicks. For once, dealing with your mortgage/bank isn’t a problem mainly because for most banks you don’t have to speak with anyone to set this up, it’s all done through the online banking interface!

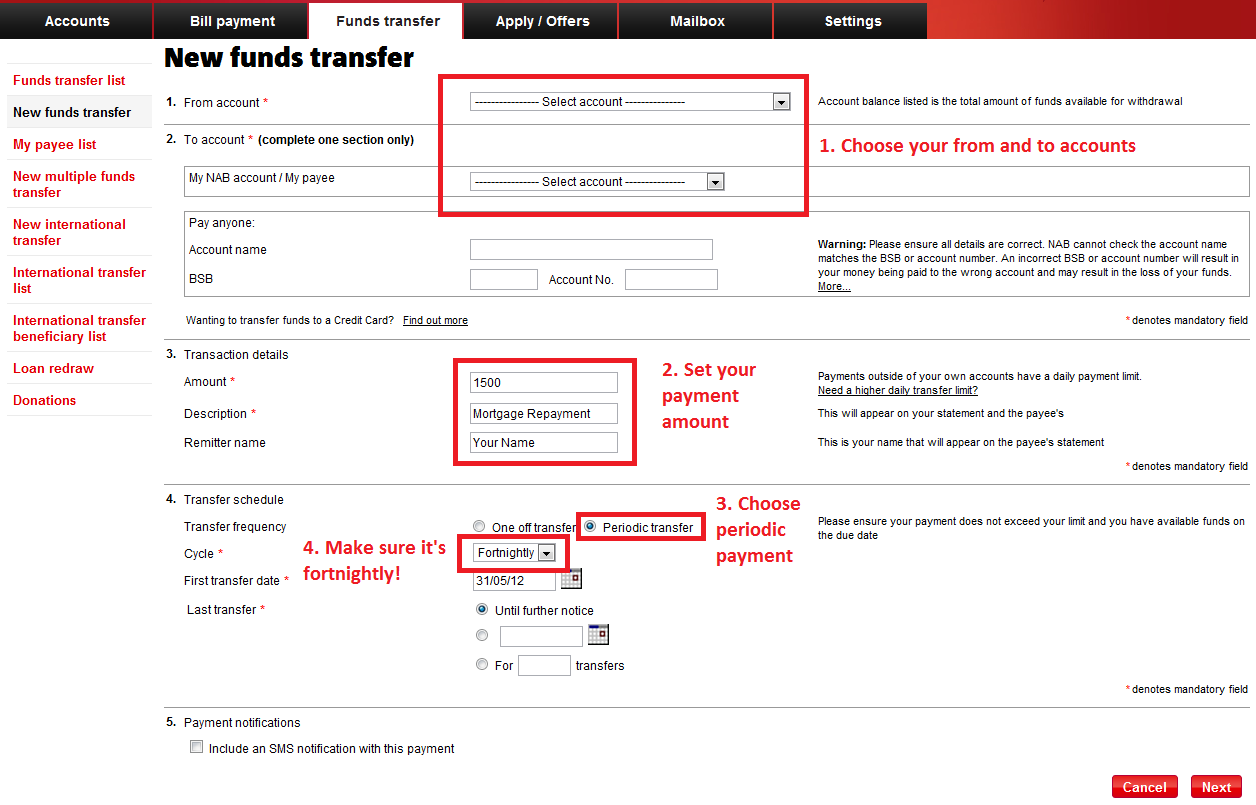

This is going to look different for different banks, but they should all look relatively similar to what’s shown below as most banks do the same things the same ways. Below is a screen shot of how to setup automatic extra payments in the National Australia Bank’s online banking website.

- Login

- Click the “Funds Transfer” link on the left

- Click the “New Funds Transfer” link

- Follow the below steps

Obviously the “To Account” should be your mortgage, the “From Account” is usually a joint account if you’re a couple or perhaps your main account if you’re single.

The “Repayment Amount” should be what you calculated before using your Excel Mortgage Calculator Spreadsheet, we suggest aiming as high as you can! Ensure the extra repayment is made periodically – this is the automatic part – and then save the transfer.

Bottom Line

Once you’ve set this automatic mortgage repayment up, you can go about your life and know in the back of your mind that every pay you’re jumping ahead of everyone else out there. That in a definitive, likely sub 10 year time frame, your house will be yours and you can move on to bigger and better things.

Additionally if you ever get a raise, shave off some expenses or just in general have access to more funds each pay cycle, it’s super easy to login and increase that repayment amount by any amount. It could be an extra $10 a fortnight if you manage to cut your phone bill down or an extra $500 if you score a huge raise. Either way it helps you to keep things simple and as efficient as possible whilst reducing headaches.

The benefits include: 1) How to pay off your mortgage faster than 99% of people with one hour a month of work 2) How to get rid of your debt and have the freedom to spend money on the things you love, guilt free 3) Clear outline of how to setup your expenses, mortgage and general finance 4) How offset accounts work and how to get the same result without being gouged by the big banks 5) How to cut through the crap and focus on the things that truly matter when taking down a mortgage 6) How to adjust the strategy so it works for you, even if you have kids, even if you only have one income 7) How to do all of these things and maintain a normal social life (and never be cheap).