As long standing, independent experts on mortgages, we believe that everyone can pay off their mortgage in under 10 years. To help with this, our free Excel Mortgage Calculator Spreadsheet with Amortization Schedule is simple to use and has all the advanced features you’ll want. With thousands of downloads and proven results already, it will help you take the next step in learning How To Pay Off Your Mortgage Faster.

Table of Contents

Simple & Advanced Features

Online calculators are great, but reset every time you close the tab and don’t work offline. With our custom built, Excel Mortgage Calculator Spreadsheet with amortization table you can easily save your progress while keeping your private information secure and having a better user experience as well. Features include:

- Beautiful, Simple Interface

- Amortization Schedule & Chart

- Shows Total Interest Paid & Saved

- Allows Mixed Income Contributions

- Works Online And Offline (Easily Savable)

- Specially Designed To Accelerated Loan Pay Off

- Manages And Integrates Income & Expenses Tracking

- Compatible With Microsoft Excel And Google Sheets

Catering for both new and experienced people, our mortgage planning spreadsheet works together with our core recommendations like making Automatic, Extra Mortgage Payments to help you pay off your mortgage fast. You will feel more in control of your finances, have a specific end date for your mortgage and be able to see in real time what effect your income and expenses have on the loans end date.

The Excel Mortgage Calculator

When we say free, we mean free. No ads. No tracking. No email sign ups. No premium locks. No DRM. No BS. Just a simple file download of an excellent resource.

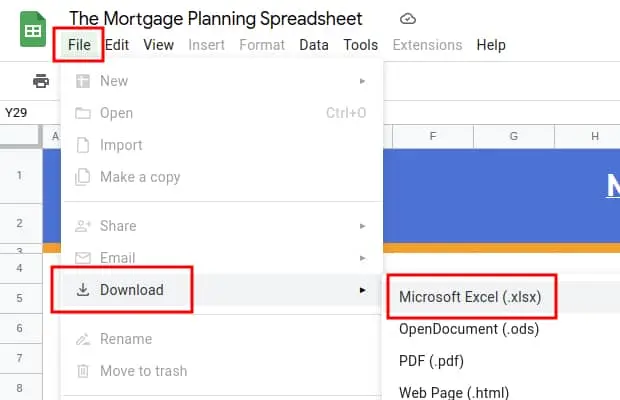

Microsoft Excel Download

To download the Microsoft Excel (.xlsx) version simply:

- Open the Google Sheets file here

- Click File -> Download -> Microsoft Excel (.xlsx)

Note: When you first open the downloaded file it will open in “protected view” as it’s a file from the Internet. You need to click on Enable Editing in the yellow banner at the top of the spreadsheet to make changes.

Use With Google Sheets

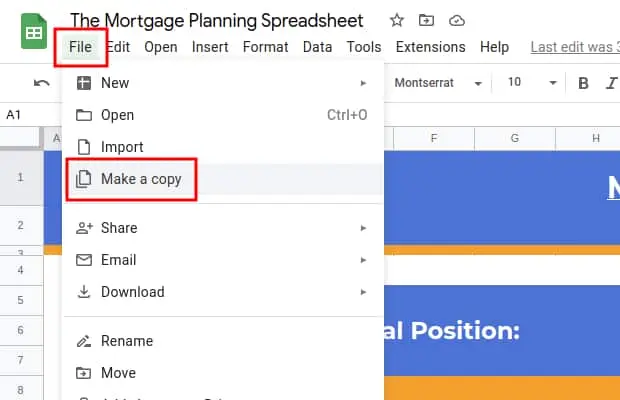

To make a personal Google Sheets copy that’s bound by your Google Account, meaning no one else has access to it or can see the private information you enter, make sure you’re signed into your Google Account then simply:

- Open the Google Sheets file here

- Click File -> Make a copy

Usage Instructions

First, please make sure you’ve gone through the various considerations and point in Should I Pay Off My Mortgage? This will ensure paying off your mortgage faster is the right thing to do for your situation.

Enter Inputs

In the Inputs tab (the tabs of the spreadsheet are located at the bottom) fill out your income and mortgage information. This includes things like your:

- Name

- After Tax Income & Debt Payments

- Loan Amount, Start Date & Payment Frequency

Next go to the Mortgage Plan tab and enter in your current interest rate in the top blue cell. As time passes, this interest rate will occasionally change and you can enter in the new rate on the appropriate dated row. This allows for the calculator to track and remain accurate.

Enter Expenses

Finally go to the Expense tab and fill in as much detail about your expenses as you can. When filling it out, don’t feel that you have to be 100% perfect.

The greatest enemy of a good plan is the dream of a perfect plan

Prussian General Karl von Clausewitz, Vom Kriege, 1832

Even if you simply estimate the numbers off the top of your head it’s better than nothing, the main focus should be on just getting some information in there. If your expenses aren’t 100% accurate then the numbers will be off, but over time you can update them and approach perfection. In truth, even my own Expenses tab isn’t 100% perfect as expenses fluctuate wildly.

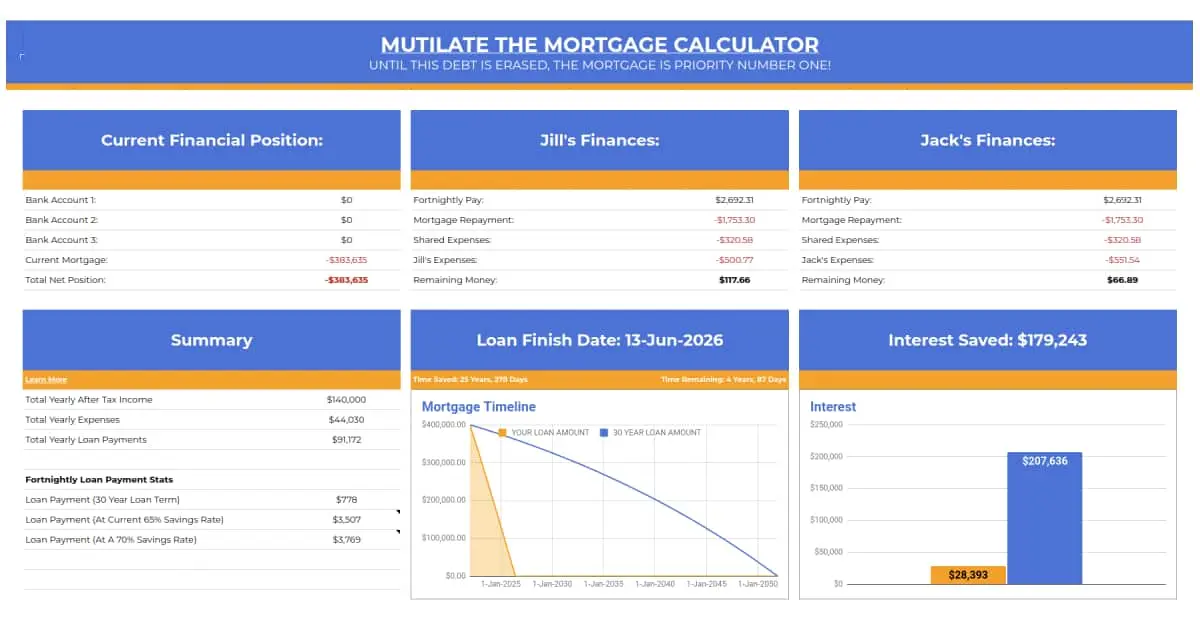

Amortization Schedule

Once you’ve entered in all the figures you can see all the automatically calculated data and graphs including the amortization schedule which is in the Mortgage Plan tab. The main area is the very first Dashboard tab which gives you a snapshot of what should be happening money wise each fortnight. Who is getting paid what, how much your loan payments should be and how much each of your expenses are. It also gives you your total net position and a graph outlining your specific mortgage plan.

We recommend using this Excel Mortgage Calculator Spreadsheet fortnightly. Each fortnight, or on your pay day, give it a quick 1-2 minute look over. Update your bank account values (as you just got paid), make sure your mortgage is at where your plan says it should be at and if you feel like it, maybe have a look at what expenses you may need to investigate.

Yes, this is an ongoing thing. Yes, it requires discipline. No, it’s not hard, it takes in total about 5 minutes per month to do and will save you hundreds of thousands of dollars. It might seem simple, but it is the secret to conquering Long Term Problems.

The benefits include: 1) How to pay off your mortgage faster than 99% of people with one hour a month of work 2) How to get rid of your debt and have the freedom to spend money on the things you love, guilt free 3) Clear outline of how to setup your expenses, mortgage and general finance 4) How offset accounts work and how to get the same result without being gouged by the big banks 5) How to cut through the crap and focus on the things that truly matter when taking down a mortgage 6) How to adjust the strategy so it works for you, even if you have kids, even if you only have one income 7) How to do all of these things and maintain a normal social life (and never be cheap).