Monthly fees? Yearly fees? Offset account or “Wealth Package” fees? Savings account fees? Everyday banking/EFTPOS fees? Credit card fees?

Does anyone like paying these stupid things? I sure as hell don’t… which is why I pay $0 every year for my banking services.

Now I’m quite a cautious person to be honest. Whenever I go and buy a product or do something reasonably major like a trip away or signing up for a new bank account I’ll normally do considerable research first. The Internet is a fantastic place full of reviews, experiences and everyone’s products, services and their respective costs for you to compare and contrast. Some people get overwhelmed or are just simply lazy and “just go with that one cause it looks fine” and I’ve often found this is very costly most of the time and what a lot of businesses expect people to do. So I thought I’d put this quite detailed post together to outline how I’ve managed to get around my whole life without dealing with any of them. Yes it’s long. Go away now if you’re too lazy to use this detailed information to improve your life.

Table of Contents

A Tale Of No Fees

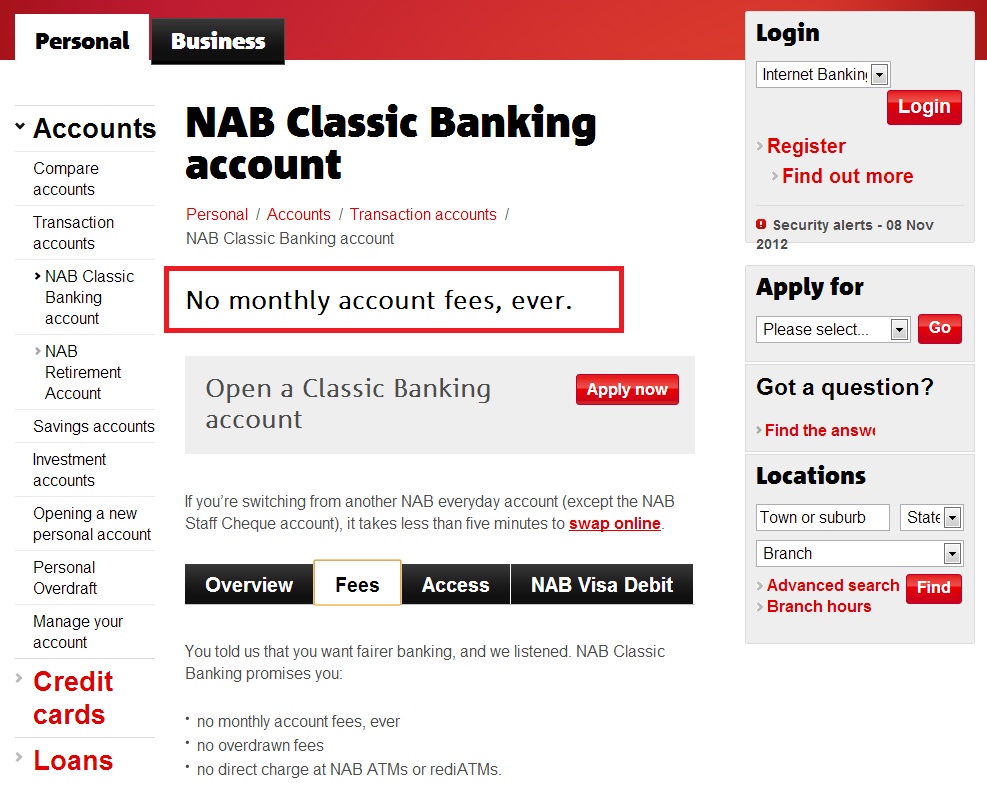

Many years ago when I was young I, like most others, was taken into a Bank with my parents and together opened up my first bank account. Now at the time it was free as I was young, impressionable and in primary school so the bank likely wanted to encourage me to start using their services nice and young. So after a few years at school using the account and not really paying much attention to it I started at Uni. Walking back into the bank to let them know that I no longer went to School any more they informed me that I was still technically a “student” (just at Uni now) and so my account fees were still waived and thus everything was all still free. Later still, after I graduated I once again went back to the bank to investigate how much this service was now going to cost me. By this stage though I was lucky enough to be in the habit of thoroughly researching around as to what the best deals where. After some searching and comparing I came across the NAB Classic Account and haven’t had an issue since. As I grew older my banking needs also grew. However thanks to proper research and negotiation I’ve never paid any fee’s to banks. Ever. (The one exception where I’ve paid money TO a bank is in the case of home loan interest.)

Some people don’t realise it, but when you deposit your hard earned cash in a bank for everyday use, they actually lend it out to other people, charge them interest on that loan and make money off it. So why on Earth would you ALSO pay them bank fees?? You’re providing THEM a service as they’re profiting off your hard earned cash! If this concept is new to you (or even if it isn’t) I’d highly recommend watching this video on Fractional Reserve Banking, it’s not complicated but it’s quite enlightening. I personally see it as an equal trade, they give me easy access to my money anywhere, any time (without any fees) and I allow them to loan my money out to others whilst I’m not using it. Seems legit yeah?

Not all accounts are equal and in some very specific circumstances I’m sure some of you will need a specific feature which will have fees attached to them. For the most part though, you should be able to cover all your banking needs without paying squat in fees. The point of this post is twofold. One, to let everyone know that if you’re currently paying any bank fees, you should be slapped. And two, to outline exactly how to never pay fees again. The four major banks of Australia have recently in the last year or two upped their game in getting rid of all sorts of fees, particularly NAB. There are still plenty of them around if you’re not careful though, so let’s get started on the various situations that one might use a bank for, and how to get that service without any fees.

Everyday Banking:

Everyday banking (for me at least) involves things like unlimited EFTPOS purchases in stores for food and petrol etc, unlimited online transactions/transfers to friends etc, a Debit Card for online and overseas/Internet purchases, unlimited ATM access and withdrawals, unlimited telephone banking (if you use it still now considering we have mobiles) and a good, usable online website for BPAY and other things like exporting your purchase history to CSV’s. That’s a lot of different services and most of the banks these days seem to be providing it all for free, however I’m sure there are many people still out there paying $5 or $8 each month just because they think “that’s how it’s done”. Well thankfully it’s not and if you are one of those people please wake up and tell them to stop charging you stupid fees.

As mentioned above, I currently get all my everyday banking for free with the NAB Classic Account. I’m not saying NAB is the only bank that will offer these features for free, I’m just saying I have personally used them and it covers every need I’ve had from buying groceries, to withdrawing money at ATM’s to BPAY. So if you can’t be bothered doing the online research yourself and just want a simple solution, click that link. If you’d prefer to stay at your current bank but they’re charging you fees…

How To Get This Without Any Fees:

If your current bank is charging you a monthly fee for everyday banking services call them immediately and simply say something along the lines of:

I am considering changing to the NAB Classic Account as it provides the same services but with no fees. What can you do about matching their offer?

That should really be all that it takes to get your fees waived but if not, say adios and cut your losses. It really doesn’t take that long to change banks, even when you factor in changing where your pay goes. With some banks charging you up to $5 per month I find it quite insulting that they’re basically just profiting off peoples ignorance and stupidity (or lack of time). Doing this will also help you warm up for dealing with the main issue…

Home Loan Banking:

Home Loans have grown over the past few decades to encompass all sorts of things from the basic “Here’s your $300,000 sir at 8%” all the way up to big fancy shmancy “Wealth Packages” involving part fixed, part variable rates, offset accounts, discounted interest rates, credit cards and so on. Most people understand the basics of home loans (that you’re borrowing money and all that) but past this things get… complicated and they simply give up and yield to the “experts”. Big mistake.

Being able to do quick comparison calculations is extremely useful when dealing with what Home Loan to choose and I’d recommend you research your banks website and their various home loans and features before speaking to them. Do the research. Do the math. The banks know that when they make things complicated it throws up a mental barrier that most people are too lazy to get around them… (hint: you’re one of those lazy people too!) So instead of getting around them they simply just accept the default and never look at it again. Another big mistake. As a mortgage is normally made up of SO much money, every percent counts and should be weighted up with every other feature. Selecting the banks default option is more often than not, more expensive for you and the bank isn’t going to let you know about it either. Sure, a “Wealth Package” might sound fancy. Heck, have you seen the “ANZ Breakfree” package deal? With a name like “Breakfree” it MUST be awesome… surely it’ll let you finally be free of your mortgage… somehow… not that they really specifically say how…

Of course this is all just advertising mumbo-jumbo aimed at extracting as much money out of their customers as possible. But for those of us who wish to mutilate the mortgage, fees and loans that drag us down are simply a non-option. The only case where it may be beneficial to pay a fee for a mortgage is if it enables you to get access to a far lower interest rate. In my experience and research though these “lower interest rates” can also be easily obtained on fee-free loans or simply by negotiating better. For example the Commonwealth loans offer a Standard Variable Rate loan and a No Fee Variable Rate loan. With the “No Fee Loan” you not only get 0.7% off the SVR loan… you also don’t cop monthly service fees either!

If you are paying fees for your mortgage the easiest way for you to get rid of them is likely to simply switch to a less fancy loan at the same bank. Some charge for this, others don’t but if they do you can also negotiate your way out of them. There are of course a few things to consider before changing such as:

- How is the newer interest rate going to affect your costs?

- Are the changing costs more than the monthly fees?

- Are you using the added features of your current account and can you do without them?

- Can you negotiate a better interest rate?

- Are you better off changing banks entirely?

From my experience, the big four banks will easily give you 0.7% off their standard variable rate however some will offer up to 0.9% off, obviously this all depends on how good you are at negotiating and how much leverage you have over the bank itself. Sometimes if your loan is quite small they won’t really care too much, but if you have a number of other high figure accounts and a large mortgage you can use this to your advantage. The main step though should be simply trying to get them to abolish those monthly or yearly fees. As an example, I use the Commonwealth Economiser Loan which I’ve negotiated down further to $0 monthly fees (as opposed to its normal $8/month) as well as another 0.21% off the already lower than standard variable rate.

How To Get This Without Any Fees:

If your current bank is charging you a monthly or annual fee for your home loan call them. Be polite, but firm and simply say:

I’ve noticed that my home loan account is being charged an account keeping fee each month and I’d like to have that removed.

It really is that simple quite often although there are some other things you can do to help your chances including::

- Enquire as to if they have a cheaper home loan plan that you can freely switch to

- Hit up this excellent resource on How To Negotiate

- If at first you don’t succeed, call back the next day and try again

- Practice what you’re going to say

- Call in the morning (9am) as it is less busy/stressful plus the operator hasn’t been destroyed by angry callers all day which means they’ll be in a much better mood

- As a final, last attempt you might start to mention to them that you’d really hate to have to leave over something as silly as a monthly fee… and see if that spurs their generosity

Credit Card Banking:

This is simple. I just use a Debit Card instead which is normally free with most everyday banking accounts. I’m still yet to hear a valid argument for why I should “need” a Credit Card. This seems to be a very hotly debated topic but after a lot of analysis it seems that in some certain circumstances they can benefit the users. However more often than not they simply get people into trouble.

Sure you can do your research and game the system by always paying it on time etc, etc but I prefer the simple and more efficient method of just not dealing with it all. I’m not saying this is what you have to do but it is possible to live your life without a credit card (I even travel regularly with it and I’m still alive!)

How To Get This Without Any Fees:

As above – just use a debit card! :-)

The benefits include: 1) How to pay off your mortgage faster than 99% of people with one hour a month of work 2) How to get rid of your debt and have the freedom to spend money on the things you love, guilt free 3) Clear outline of how to setup your expenses, mortgage and general finance 4) How offset accounts work and how to get the same result without being gouged by the big banks 5) How to cut through the crap and focus on the things that truly matter when taking down a mortgage 6) How to adjust the strategy so it works for you, even if you have kids, even if you only have one income 7) How to do all of these things and maintain a normal social life (and never be cheap).