Before we paid off our mortgage and before we even bought our house we actually bought an entirely different house. We signed the contract, put down the deposit and everything… subject to building inspection.

That was an extremely good clause to have because when the inspection results came back we were quite shocked!

The house was brand new, had just been built and looked very nice with a gorgeous kitchen, hardwood floors and deck in the backyard. Unfortunately the building report told a different story. There was no insulation in the roof, the main wall was not only crooked but had gaps between the bottom and the floor.

The backyard area, which went down into the single garage, also didn’t have any drains. This meant whenever it rained the whole backyard and garage would flood!

All this obviously voided the contract and we got our deposit back but it serves as an excellent point. Even when starting out you need to know how to buy a house. Otherwise it’s very easy to get stuck with a dud!

Table of Contents

The Centre Of Your Life

The very first thing you need to consider is location. Most know they want to live in suburb X but you should go further. Don’t just consider work and schools, below is a rough list of everything you might want near you and how often a family may use them:

- Work / Train Stations – 5 times / week

- School / Child Care – 5 times / week

- Sports / Gym / Etc – 1-4 times / week

- Grocery Shopping – 1-2 times / week

- Family / Friends – 1-2 times / week

- Parks / Libraries – 1 time / week

For many places, living close to the CBD area hugely increases the price. However if you know you’re always going to work in the CBD, try and instead make sure a good train station is within walking distance. This way you can still purchase a reasonably priced house but easily get to work.

Make sure the station is safe and the right distance from your home. You don’t want to be next door as typically areas around train stations are less safe. They’re also noisier due to the trains. You don’t want to be too far away either as otherwise you’re forced to drive and park there. Then your car is at risk of being stolen, backed into or worse. It can also be a nightmare to find parking too.

I’d recommend around 500m-2 km. Beyond 500m isn’t noisy and most people are happy to walk for 15 minutes each day. The forced walking is also great incidental exercise too.

Schools, Sports, Shopping And Family

You’ll want to apply the same logic to schools too. Make sure the house is within walking distance. This will allow your children to easily walk home on their own when they’re old enough. While they’re young you can walk them there yourself, teaching them good habits and getting even more exercise.

Next we have something most people don’t consider. How close is this new area to your regular sports or recreational activities? If you do indoor soccer 3 times a week but you have to drive 45 minutes in each direction to get there it’s going to be a huge pain. Likewise if there’s no good shops, friends or family anywhere near you’re going to be spending your life driving.

This is not only a huge waste of your time, energy and money but puts you at a much higher risk of injury due to car crash. Instead try and find a balance between them. If you see your family 5 times a week but only play soccer once then preference them.

Also remember that family often becomes a critical child care component when kids come along. Having the new baby at your parents’ house for two days a week can save thousands in child care costs plus be great for the grandparents.

Balancing Act

Obviously you’re never going to get your perfect location. Instead draw up a list just as I have above with where you frequent most and how often. Use it to start drawing boundaries around those key points that you spend the most time at. Once you have 5-10 potential suburbs that won’t result in you driving for 80 hours a week you can then begin researching them.

Research!

When most people think “research” they think Googling the suburb or maybe driving around it to get a feel for it. Fortunately these days there’s far more sophisticated ways of going about it!

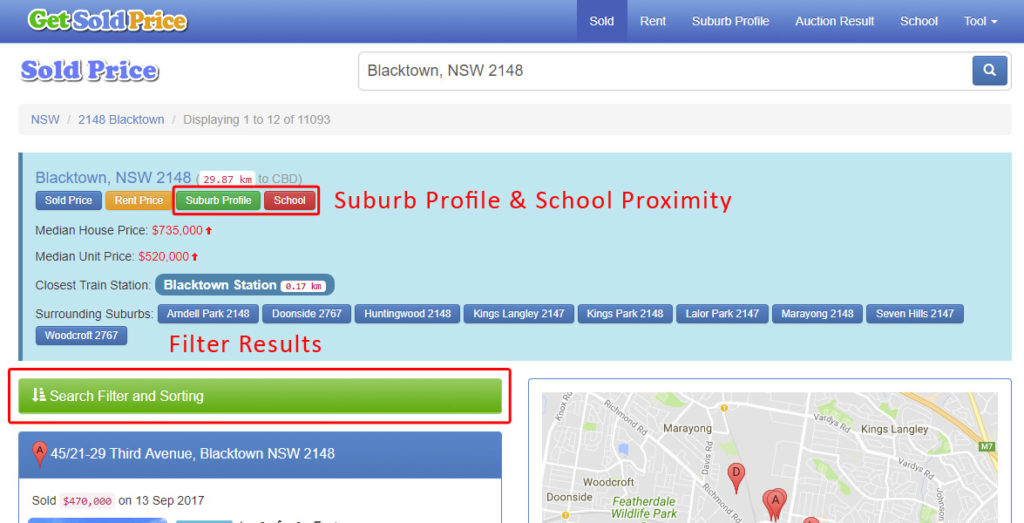

If you’re in Australia there’s a great website called www.getsoldprice.com.au. Here you can type in your target suburb and get instant stats on it. By default it will show you the most recent sales with the ability to filter down on bedrooms, land size, price etc.

You also get handy maps showing how close all the schools are, median house/unit prices, distance to CBD and loads more. You can even enter all 5-10 suburbs into the top search box and it will compare them.

This way you can easily see if there’s any diamonds in the rough. Perhaps there’s one that’s close to the CBD but is quite cheap. Maybe a suburb you assumed was “unsafe” shows up as having fewer assault / robbery / crimes in it than that other fancier suburb that costs more?

At a bare minimum it will help you narrow in on previous house sales in that suburb or even street. This way you can legitimately answer the question “how much is that house worth?“.

Live Example

Let’s imagine you’re looking to buy a house on Bent Street, Chester Hill, NSW 2162. You’re thinking about buying a 3 bedroom house that has around 500-600 sqm of land. You see a house that’s for sale for $800,000 and want to know, is it worth it?

Click on this link to see how this search looks. There’s plenty of houses all around Bent Street with their sold prices, pictures and more. You browse through them and find two or three recently sold houses that match up quite closely with the one you’re looking at. Between the three examples you notice that their prices are more in the $850,000 – $900,000 range. This means that if you can get that house for $800,000 it’ll likely be a great deal.

Regardless I’m sure you can see it’s an excellent tool to use. Before you even go to house inspections you should know your suburb and area’s inside out. Are they safe? What’s the average house prices? Are there many houses for sale right now? What have houses similar to the one you want sold for within the past year?

All these questions will give you a big edge over other sellers and the real estate agent. It will also protect you against over paying not to mention save you tons of time. If you can browse a website or two and discount a few suburbs then that’s a lot of house inspections you’ve saved!

Just Another Bedroom…

While you’re narrowing down what suburb you’ll be living in, have a good think about the size of your house too. For some reason the default seems to be that you need 1 bedroom per child but I distinctly remember growing up sharing a bedroom with my brother.

Buying a house with more space than you need not only adds extra upfront costs but large amounts of ongoing costs too. You’re paying more interest on that mortgage because of it. You’re paying more to heat/cool it. More rooms means more furniture to purchase, higher insurance premiums and more headaches when cleaning.

Many houses also have completely useless rumpus or living areas. They’ll have a kitchen, dining, formal dining, rumpus area, living area, second living area and so on. Think long and hard about exactly how much space you’ll need. Also be aware the average length most people stay in any given home is 5-10 years.

Negotiation

I’ve covered this in depth before for FHB’s but you need to learn how to negotiate! Negotiation can easily save you tens of thousands of dollars even by just practising for a few hours. To have the confidence and prepared wording is an amazing feeling.

Practicing answering common negotiation tactics as well as having your research is also a very powerful combination. Few people, real estate agents included, can argue successfully against clear facts.

As an additional point, never, EVER reveal your price! Not while you’re chatting to the agent, not after you’ve signed. Never. It is one of the few pieces of leverage you’ll have and you should learn to use it to your advantage.

Ignore That Agent

For an in depth look at why you should essentially ignore all real estate agents, have a quick read up on what really motivates them here.

Put bluntly they don’t work for you and they don’t even work for the seller. They work only for themselves and are focused on getting the sale done quickly. That’s all. As such virtually all information they deliver should be subject to great suspicion.

The remarks about “other buys” or “other offers” or “other houses that have sold for $X”. Ignore it and do your own research. Also don’t trust any information about the sellers they may tell you. Again, they’re working only for themselves and a quick sale. So chances are they just want to get you and everyone else into a buying frenzy as quickly as possible.

You can also use this to your advantage by demonstrating that you can buy the property very quickly (if that’s your goal). This will undoubtedly bring the agent onto your side which means he’ll be actively fighting for you next time he talks to the sellers!

The Ultimate Guide To Buying A House

Buying a house is by no means a simple thing to do properly. Even when you know exactly what you’re doing it can take months to find just the right match. At the very least though make sure you go through the following steps.

- Calculate how much you should be borrowing

- Analyse your everyday life and come up with 5-10 suburb choices that are centred around it

- Research those suburbs and narrow in on 2-3, then deeply research those 2-3

- While you’re looking up potential houses make sure you

- Learn to negotiate better

- Research the best loans based on your deposit

- Understand the agent and their motivations

- Know Your FHOGs:

- Once you find your house make sure you go through the quick lists below to ensure you’re covered

Check Off All These Before Signing A Contract Of Sale

- The contract must be subject to financial approval from the specific bank you have pre-approval with and them ONLY. It must also give you at least 2 weeks or more to get the approval.

- The contract really, really should be subject to a building and pest inspection. It must also state that it’s completed “satisfactory to YOUR approval” no one else’s

- When you determine a deposit amount, make sure you will still have at least $4,000 or more in your account after for other upfront costs

- The contract must state that you will pay the deposit on or after the day you receive final financial approval from the bank

- Have you received and read the Section 32’s?

- If there are Body Corporate Rules, have you received and read them? Are you OK with all their rules?

- If the property is still being built, the contract must have an agreed upon completion date in it to prevent the build dragging on with penalties if they breach that date.

- If there has been any renovations on the property, have you contacted the council to check on them and if they had a permit for it?

- Have you inserted in the contract a date upon which your offer will expire? State a time period of 3 days, this way you know if your offer is rejected and can move on even if they don’t call back

Some Other General Notes (Potentially Australian Specific):

- A Solicitor is more qualified than a Conveyancer

- The 3 day cooling off period is 3 clear business days

- Have a conveyancer check over the Section 32’s during the 3 day cooling off period

- Try and have the Building and Pest inspection done during the 3 day cooling off period

- You can’t deal with a builder directly until settlement is done. You can communicate through the seller though

- Verbal offers are not legally binding, but you may need to give a deposit (eg $1,000)

- Offers are binding when the contract of sale (or contract note) has been signed by both parties AND all conditions are met

- To end a contract during the cooling off period you need to provide written notification

- Make sure the advertised land area/borders match the official title or plans

- The building inspection must produce a “professional condition report” and complete a 300 point check of the house

So how did the purchase of your house go? Were there any problems that these points would have stopped? Do you find yourself too far from everything now or have there been other unforeseen problems? Let us know in the comments below!

The benefits include: 1) How to pay off your mortgage faster than 99% of people with one hour a month of work 2) How to get rid of your debt and have the freedom to spend money on the things you love, guilt free 3) Clear outline of how to setup your expenses, mortgage and general finance 4) How offset accounts work and how to get the same result without being gouged by the big banks 5) How to cut through the crap and focus on the things that truly matter when taking down a mortgage 6) How to adjust the strategy so it works for you, even if you have kids, even if you only have one income 7) How to do all of these things and maintain a normal social life (and never be cheap).