In a previous post I mentioned that most people don’t give their mortgages the attention they deserve. That they simply plod on with their existence worrying about the smaller things in life that they can visibly see every day. We humans are very visual creatures you see and the old adage “out of site, out of mind” I’ve found is one of the most truest and more useful sayings to help you in your life. It is also the reason I am such an advocate for tracking your mortgage and having at the very least a spreadsheet for it.

Table of Contents

Make A Budget!

Now whenever someone says “make a budget” or “do a spreadsheet” most regular peoples eyes glaze over… their minds drift off into candy mountain with Charlie (God I love that video lol) and they never end up doing anything. One of the main reasons for this is that people underestimate just how important paying attention to their mortgage is. They brush the matter off with sayings like…

I’m just not interested in finance or money issues…

or

We’re already in so much debt… so what’s a little more?

or

I can’t plan my own finances, I don’t know anything about money…

or

I earn a decent salary and it’s never been a problem before…

or

I just don’t know where it all goes…

Any of those sound familiar?

Well I’d like to try and take some of the emotion out of it and put the debt of a house in context a little. Rather than just yelling “do a budget” or “make a spreadsheet” without making it clear why you should do these things I’m going to explain the why first and then let you decide if you think it’s worth the effort of making a spreadsheet.

Compare And Contrast

| Issue: | Money Involved: | Care Factor: |

| Home Loan | $400,000+ @7% per year | Most don’t really pay much attention to it |

| Car Loan | $20,000+ @14% per year | Most don’t really pay much attention to it |

| Cost Of Petrol | $3,120 ($1.5/Lt * 40Lt’s * 52 weeks) | Most get outraged any time it increases even 10 cents |

| Cost of Groceries | $7,800 ($150 * 52 weeks) | Most get outraged any time it increases |

| Cost of presents for Birthdays | $400 ($40 a present * 10 family/friends) | Most complain or grumble each time we have to fork out the money |

Notice any pattern? In the day to day we complain and get outraged over small aspects of money. But when you look at that list it’s pretty clear what you should be grumbling over… the $28,000 ($400,000 * 7%) you’re paying every year in interest for your $400,000 mortgage!

That’s It!

That’s actually my entire argument because it’s just that dead simple a reason. Why would you complain about rising prices in coffee or petrol or child care or anything for that matter when every year you’re being punished with $28,000 worth of interest that you could get rid of?! It makes no sense logically but almost everyone does it daily and I now have to willingly stop myself from slapping people when they do it in front of me. I want to grab them by the collar and just yell at them “Why do you care about 10 cents worth of petrol when you’re willingly throwing hundreds of thousands of dollars down the drain by never bothering to care about your mortgage???“

Zero Shits

You should give absolutely zero shits about anything being any price until you address your mortgage first, it is that important. Buy 10 coffee’s a week, I don’t care! But make sure you are paying serious attention to that mortgage balance and how to cut it down as that will save you thousands of dollars more in the long run.

10 coffees * $4.50 per coffee * 52 weeks * 10 years = $23,400

or…

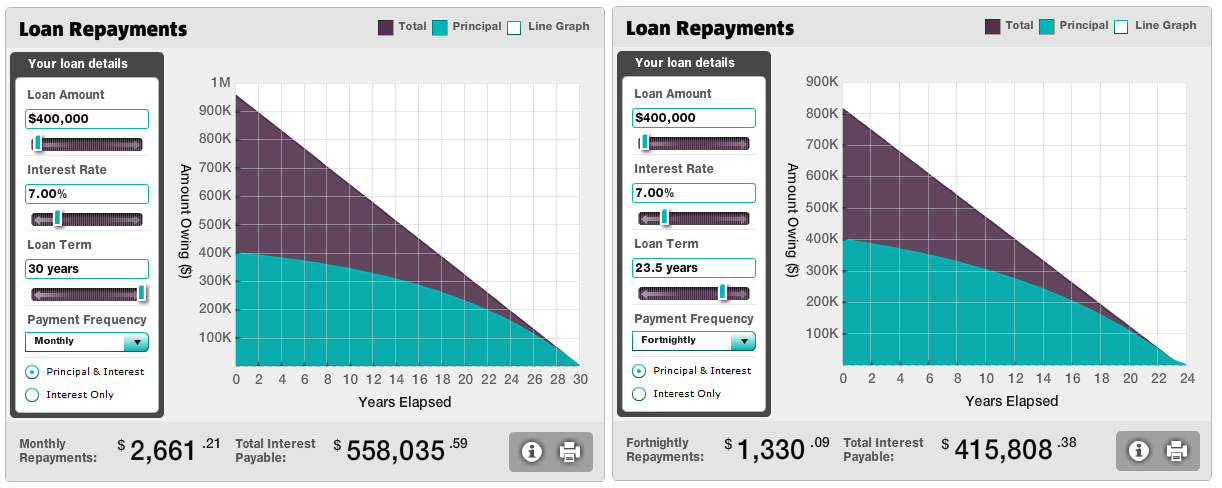

Use our advice with the Excel Mortgage Calculator on a $400,000 mortgage @ 7% and you will save $142,227.21

As you can see, the difference in how much interest you’ll pay ($558,035.59 – $415,808.38 = $142,227.21) is immense and the bigger your mortgage is, the less you should care about anything else. Do you feel bad about buying expensive lunches at work instead of making them yourself? Well don’t! Yup, this is a financial advice site telling you to buy that damn lunch and ignore that small, immediate problem because your mortgage is much, much bigger. Would you worry about your lunch bag being on fire whilst standing in front of your house on fire?

A Spreadsheet Is A Small Price To Pay

As a mortgage should be the top priority in anyone’s financial life, it deserves the highest attention. How much time do you worry about buying the cheap vs more expensive thing? How about how much that holiday will cost or planning out a holiday for that matter? We might spend hours and weeks planning a holiday going to countless flight agents or talking it over with friends or family whether Hawaii is better or maybe Thailand and this is only dealing with a few thousand dollars! A spreadsheet that takes 3 minutes to fill out each fortnight is pittance in comparison to that and yet many flat out refuse to do it because “it’s too much work”.

So when I say start with our simple Excel Mortgage Calculator from now on you should really consider it almost a bonus. Here you are spending hours, days and even weeks organising things that cost a few thousand dollars and I’m offering you a way to easily outshine any of those results with only a couple of minutes! I’d actually consider it a gift!

The benefits include: 1) How to pay off your mortgage faster than 99% of people with one hour a month of work 2) How to get rid of your debt and have the freedom to spend money on the things you love, guilt free 3) Clear outline of how to setup your expenses, mortgage and general finance 4) How offset accounts work and how to get the same result without being gouged by the big banks 5) How to cut through the crap and focus on the things that truly matter when taking down a mortgage 6) How to adjust the strategy so it works for you, even if you have kids, even if you only have one income 7) How to do all of these things and maintain a normal social life (and never be cheap).