Making Automatic, Extra Mortgage Payments towards your mortgage is the first thing you learn in How To Pay Off Your Mortgage Faster. It allows you to save hundreds of thousands of dollars in interest and greatly accelerates your life, but the natural question then is, how much extra should I pay on my mortgage?

Table of Contents

What Does Paying Extra On Your Mortgage Mean?

Paying “extra on your mortgage”, “making extra repayments” or “prepaying your mortgage” all refer to making additional payments towards you principal loan balance. These additional payments are on top of your regular payments. For example, if your fortnightly mortgage payments are $500, you might pay an extra $100 each fortnight to the principal for a total of $600 per fortnight.

While there are many reasons to do this, the main one is that by paying off the principal quicker, you save money by paying less interest over the course of the loan. This can be tens, or even hundreds of thousands of dollars!

What To Consider Before Prepaying Your Mortgage

It’s important to consider your entire financial situation before deciding how much extra to pay on your mortgage. This is because there are a number of things that can actually leave you worse off if you’re not careful.

- Do you have other higher interest debts? Credit Card or other loans that have a higher interest rate will build up interest faster than your mortgage, so you’ll save more money focusing on these first

- Do you have other financial obligations? If you have other big ticket items coming up soon like needing a new car, new hot water system or school fees you might want to focus on them first, then come back to your mortgage after

- Does your mortgage lender / bank doesn’t allow for more frequent / higher repayments? Quite often, especially with fixed interest loans, your lender or bank might not allow you to make higher or more frequent repayments. If they do, there could be a limit (for example $10,000 per year) so make sure you’ve confirmed with them that what you’re planning is allowed and that you won’t be penalised

- Can you get a company match from a workplace retirement plan? Companies (often in America) can offer a company match of 50-100% of your contribution up to a limit. This “free money” can greatly help your retirement contributions and might be something you wish to add to first before paying extra towards your mortgage

As a final check, it’s also recommended that you should have at least 1-3 months worth of emergency funds saved up just in case something unexpected like a loss of job or health issue occurs. You can also read about a few other considerations to take into account in our more in depth piece Should I Pay Off My Mortgage?

How Much Extra Should I Pay On My Mortgage?

When determining how much extra to contribute, every person and family is different. It’s also simpler to understand with an example, so let’s go through two different options (Typical and Advanced) with an example 30 year loan of $400,000 at a 3% interest rate. You can play along using this repayment calculator if you want too.

Typical Advice

Most typical advice comes from banks or home loan lenders, which isn’t really a good place to look. While these institutions obviously have a wealth of experience with mortgages, they also have a business incentive to make you pay as much interest as possible, as that’s where their profits come from.

While most don’t offer bad advice, none of them really encourage borrowers to pay large amounts of money as this would mean more savings for you and less money for them. This usually results in them suggesting you pay small extra amounts like $25 or $50 per fortnight.

Another very typical piece of advice is the magical “28%” or “30%” rule. The one that says something along the lines of Your loan repayments shouldn’t be any more than roughly 30% of your income, otherwise you might not be able to pay the debt off safely. While this again isn’t bad advice, it still results in small amounts.

That being said, even putting small amounts such as $100 per fortnight extra can still make a big impact as you can see below. These smaller amounts are also excellent for those who are just starting out or for those who just don’t have thousands of extra dollars each month to spare.

| Repayment Amount | Loan Term | Total Interest | Interest Saved |

|---|---|---|---|

| $779 / Fortnight | 30 Years | $206,703 | $0 |

| + $100 / Fortnight | 25 Years | $167,763 | $39,347 |

| + $200 / Fortnight | 21 Years | $141,436 | $65,674 |

| + $300 / Fortnight | 19 Years | $122,376 | $84,735 |

Advanced Advice For Mortgage Mutilators

If you want to get a huge, Big Win in your life and do something special like paying off your mortgage in under 10 years, then our advanced advice is for you!

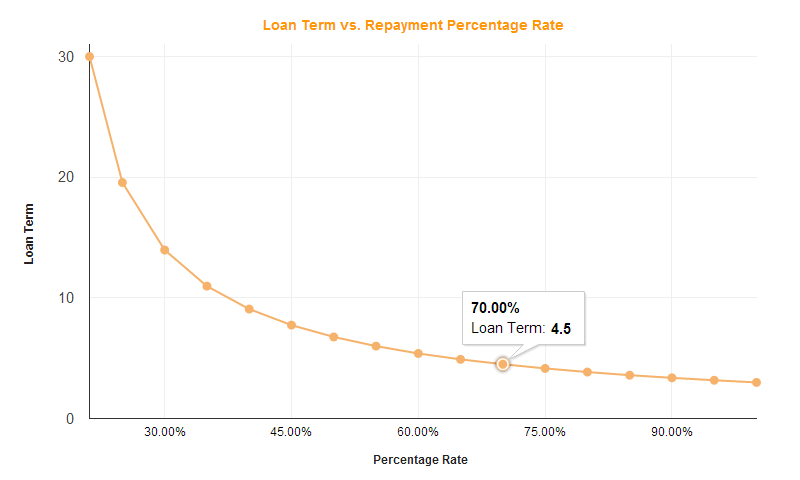

So how much extra should you pay towards your mortgage? We recommend pushing 70% of your after tax wage towards your mortgage. Yes, 70%. We don’t sugar coat this here, it absolutely takes work to do this. It takes proper motivation. Many will claim it’s impossible. It’s not. Many of our readers have already achieved this and we like to raise the bar when it comes to aggressively paying off your mortgage as it gets massive results.

To figure out how much of your after tax wage is currently going towards your mortgage simply divide your mortgage repayment by the salary that you get in your bank account each pay. For example, if you receive $2,500 per fortnight in your bank account as a salary and your mortgage payment is $750 per fortnight, then your current rate is $750 / $2,500 = 0.3 = 30%.

To get to 70%, you’d need $2,500 * 0.7 = $1,750 per fortnight (this would be made up of the original $750 + an extra repayment of $1,000 per fortnight).

| Repayment Amount | Loan Term | Total Interest | Interest Saved |

|---|---|---|---|

| $779 / Fortnight | 30 Years | $206,703 | $0 |

| + $1,000 / Fortnight (70%) | 10 Years | $63,368 | $143,743 |

70% should also be considered the end goal. Few people are able to go straight from their normal repayments to 70% so don’t worry if you can’t either. If you’re only paying 30% or 40% currently that’s fantastic! Focus as much time and energy as you can on learning How To Save Money and push towards that 70% goal.

It’s also important to understand that everyone is different, two people both working full time with no kids are going to have a lot more available funds than a single parent of two kids. As such, it’s important to be upfront about your position and what your expectations are. Below are some suggested time frames for how long it will take for you to pay off a roughly $300,000 loan amount, assuming you’re hitting that 70% mark:

| Single Income Of | Loan Term |

|---|---|

| < $70,000 | 15+ Years |

| = $70,000 | 11-13 Years |

| > $95,000 | 6-7 Years |

| Couples Income Of | Loan Term |

|---|---|

| < $140,000 | 7+ Years |

| = $140,000 | 5-6 Years |

| > $180,000 | 3-4 Years |

This advanced path enables you to beat the banks at their own game. You’re securing your future and instilling lifelong saving habits that will set you on the path to financial freedom long after you own your house.

How Much Will You Save By Making Extra Repayment?

The higher your extra repayment amount is, the more interest you’ll save. You’ll also see your loan term reduce exponentially meaning you’ll be free of the debt quicker. Once again, let’s see how this looks with the Typical advice and our Advanced method.

Typical Example

Even putting $100 or $200 per fortnight extra towards your mortgage certainly helps and makes a pretty big difference to both the interest saved and loan term. This typical advice from many banks allows you to get a quick, and usually pretty easy, win by knocking 5-10 years off your loan straight away.

| Repayment Amount | Loan Term | Total Interest | Interest Saved |

|---|---|---|---|

| $779 / Fortnight | 30 Years | $206,703 | $0 |

| + $100 / Fortnight | 25 Years | $167,763 | $39,347 |

| + $200 / Fortnight | 21 Years | $141,436 | $65,674 |

To make these sorts of calculations using your own numbers, you can use a Repayment Calculator that allows you to add on extra repayments. Simply enter in your own mortgage details like loan size and interest rate, then add on your extra repayments to see what impact it’ll have.

Advanced Example For Mortgage Mutilators

For those wanting to be even more aggressive and get even bigger savings you should be able to get a sense of what increasing the extra repayment amount gets you from below. As you push higher towards that 70% number you can save well over $100,000 in interest.

| Repayment Amount | Loan Term | Total Interest | Interest Saved |

|---|---|---|---|

| $779 / Fortnight | 30 Years | $206,703 | $0 |

| + $250 / Fortnight (40%) | 20 Years | $131,203 | $75,908 |

| + $500 / Fortnight (50%) | 15 Years | $96,536 | $110,575 |

| + $750 / Fortnight (60%) | 12 Years | $76,478 | $130,633 |

| + $1,000 / Fortnight (70%) | 10 Years | $63,368 | $143,743 |

As the extra repayment amount increases and the loan term drops, you get diminishing returns. This means that although you’re putting in more and more money, your loan term – and interest saved – doesn’t reduce as much each time.

This is why we recommend aiming for the quite high 70%, but not much higher than that. Although some get to 80%, the amount of bang for your buck isn’t as great so we suggest focusing on other things instead, such as earning more money.

How Do You Make Extra Repayments?

The recommended way to do this is to setup an extra Automatic, Extra Mortgage Payments each time your normal payment comes out. This allows you to not only change the amount quickly and easily in the future, it also makes the process automatic, greatly increasing the likelihood you’ll stick to it throughout the long term.

If your home loan offers an Offset Account or Redraw facility then you can also use these to make the extra repayments. This way you can take the extra money back out again if there’s any emergency or need for it.

Quite often, especially with fixed interest loans, your lender or bank might not allow you to make higher or more frequent repayments so it’s good to check with them first. If they do, there could be a limit (for example $10,000 per year) so make sure you’ve confirmed with them that what you’re planning is allowed and that you won’t be penalised

If you’re in the US, you should also make sure to inform your lender that these additional repayments are to be applied to the principal, not interest. If you don’t, the lender can apply them to future scheduled repayments which won’t save you any money.

The benefits include: 1) How to pay off your mortgage faster than 99% of people with one hour a month of work 2) How to get rid of your debt and have the freedom to spend money on the things you love, guilt free 3) Clear outline of how to setup your expenses, mortgage and general finance 4) How offset accounts work and how to get the same result without being gouged by the big banks 5) How to cut through the crap and focus on the things that truly matter when taking down a mortgage 6) How to adjust the strategy so it works for you, even if you have kids, even if you only have one income 7) How to do all of these things and maintain a normal social life (and never be cheap).