How do you pay off a mortgage in 5 years?

When we first started with our home loan I didn’t have much of an idea what to expect. I didn’t have any specific type of “plan” to follow besides the social default of pay it off for 30 years. It took me quite a while to suss everything out, learn what matters and what doesn’t. Now I’m fully confident at paying off a mortgage really, really quickly. So let me give you the low down!

Table of Contents

If I Could Start Over…

I’ve often said that if I had this website from the day I started paying off our mortgage it would have only taken us 5 years not 6.

A year or so ago I sat down and wrote out a very detailed and non-specific post entitled How To Pay Off Your Mortgage Faster. If you haven’t read this I’d highly recommend you do. It’s the main theory behind the more detailed figures below. Once you’ve read it, come back here and this post should make more sense.

Although the article above is very general and does cover the below case, I thought I’d run through specific figures. Hopefully it gives everyone a better understanding of how it’s done with a specific use case. If you’d like, feel free to post a comment below with other starting details and I can do another article if those are popular.

The 5 Year Plan

This specific 5 Year Plan is for a couple that has the following traits:

- A combined income of $150,000 (50/50 each)

- No children

- Wants to be debt free within 5 years so they can do _______

If this scenario doesn’t fit your case too well, there are 48 different permutations below:

- The Ultimate Guide To Paying Off Your $100K Mortgage

- The Ultimate Guide To Paying Off Your $200K Mortgage

- The Ultimate Guide To Paying Off Your $300K Mortgage

- The Ultimate Guide To Paying Off Your $400K Mortgage

Now a very common issue with paying off a mortgage so quickly is that many have a mental block and believe it “can’t be done” with children. Well besides from the fact that it can be done, in this scenario I would imagine the couple might want to pay off their mortgage first in preparation of having children.

Besides from the different mortgage size permutations listed above, those cases also include having children. So if you’re suspicious of this plan working because you have children already, be aware that those links will give you more info for those specific cases.

Our Couples Income:

While most couples don’t have an exact 50/50 split income, it should be easy enough for you to redo the calculations below and figure out your own total income after taxes.

According to the ATO’s Simple Tax Calculator:

| Jack’s Base Income: $75,000.00 | Jill’s Base Income: $75,000.00 |

| Jack’s Current HELP Debt: $0.00 | Jill’s Current HELP Debt: $0.00 |

| Jack’s Annual Tax: -$15,922.00 | Jill’s Annual Tax: -$15,922.00 |

| Jack’s Take Home Pay: $59,078.00 | Jill’s Take Home Pay: $59,078.00 |

Total Income After Taxes: $118,156.00

Total Income: $4,544.46 / Fortnight

Our Couples Expenses:

Below you can see a big long list of expenses our mythical couple might have. While your expenses will obviously be different I don’t think it’s too unbelievable to see the below figures as a reasonable amount of expenses.

Ultimately the exact expense and amount really doesn’t matter as they should only account for ~30% of your after tax wage or $1,363.34 per fortnight in this example once you’ve properly gone through them all and ensured they’re as efficient as possible. If they don’t, get to work on cutting those expenses!

| House Gas: | $700 |

|---|---|

| House Insurance: | $1,000 |

| House Internet: | $960 ($80 Per Month) |

| House Power: | $2,000 |

| House Rates: | $1,500 |

| House Water: | $1,000 |

| Food: | $7,020 ($125 Per Week) |

| Car Insurance: | $1,800 ($900 * 2 Cars) |

| Car Rego: | $1,630 (As Of 2018) ($815 * 2 Cars) |

| Car Petrol: | $4,680 ($45 Per Week * 2 Cars) |

| Car Services: | $1,000 ($500 * 2 Cars) |

| Mobile Phones: | $1,200 ($50 Per Month * 2 Phones) |

| Private Health Insurance: | $4,000 ($2,000 * 2 Persons) |

| Presents (eg. Birthdays): | $2,000 |

| Sports/Exercise: | $1,600 ($800 * 2 Persons) |

Total Expenses: $32,090 or $1,234 / Fortnight

Even with the reasonably generous figures above (it’s possible to get your expenses even cheaper!) we’re still not approaching that 30% mark of $1,363.34 per fortnight. In fact there’s a yearly difference of $3,356.

This means that our imaginary couple could splurge even further buying Netflix, going on holidays or even just putting more into the home loan.

The Loan:

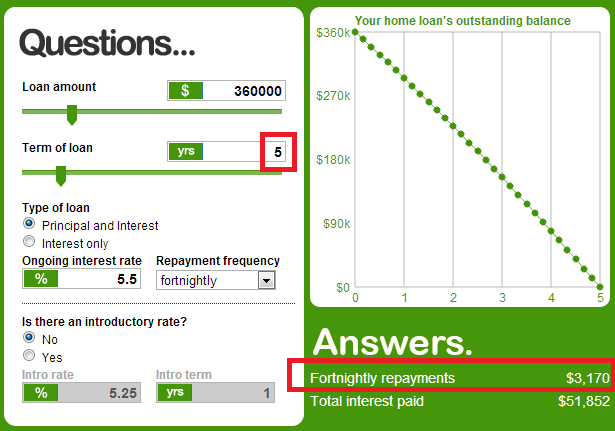

As 30% is going to expenses, 70% should be going to the loan or $3,181.12 per fortnight. Given their goal is to have their mortgage paid off within 5 years we jump over to a Loan Repayment Calculator and punch in the figures.

I’ve assumed an ongoing interest rate of 5.5% p.a. here. Do note these historically low interest rates likely won’t stay around forever. It’s quite likely interest rates will rise to 7-8%+ in the future as that is what they have been historically.

Regardless, at 5.5% and repayments of $3,181.12 per fortnight it shows this mythical couple can borrow $360,000 and pay it all off in that 5 years.

Assuming that this is a 80% loan to value ratio mortgage (ie. the mortgage is only for 80% of the total cost of the house) this means we get a house valued at $360,000 / 0.80 = $450,000.

If you were to redo the above with a more common interest rate you see now – about 3.7% to 4.5% – you’d get even more favourable results!

The Results:

So in the end this couple can rock this exact plan and be free in 5 years if they:

- Put 70% of their after tax wage to their mortgage as recommended in How Much Extra Should I Pay On My Mortgage

- Buy a $450,000 house with a 20% deposit ($90,000) or otherwise end up with a $360,000 mortgage

And that’s it!

It might seem like a pretty “light on details” plan. That’s because at the heart of it paying off your mortgage is very simple. Force that repayment amount to 70% and burn through that mortgage as fast as you can!

There are ways to live a very comfy life on $1,363.34 per fortnight when you have no kids. If this is where you’re having issues read other huge, 5 part series on decreasing expenses and focus on that.

I’d strongly recommend just upping your repayments to 70% of your after tax pay and seeing how you go. So long as you have a free redraw or offset account that you can easily get the money back out of if things end up getting really sticky.

As mentioned before, feel free to shout out in the comments some other scenario’s and I’d be happy to draft them out in other Use Cases posts.

The benefits include: 1) How to pay off your mortgage faster than 99% of people with one hour a month of work 2) How to get rid of your debt and have the freedom to spend money on the things you love, guilt free 3) Clear outline of how to setup your expenses, mortgage and general finance 4) How offset accounts work and how to get the same result without being gouged by the big banks 5) How to cut through the crap and focus on the things that truly matter when taking down a mortgage 6) How to adjust the strategy so it works for you, even if you have kids, even if you only have one income 7) How to do all of these things and maintain a normal social life (and never be cheap).