This weeks guest post comes from Lendi, another great company that’s focused on helping Australians get a mortgage at a great rate. On MTM we’re all keenly aware that paying off your mortgage fast is a huge life win… but many people out there just go with the “default big bank mortgage rate” and throw away thousands over the years as they pay more interest than they should. So today Lendi are going to show us what to look out for when shopping and how to compare mortgage interest rates properly once and for all. Take it away!

We’re going to give you our take-home message straight off the bat: the advertised interest rate does not tell the whole story. In other words, when choosing a mortgage, you need to take a holistic approach rather than just comparing the advertised figures.

This guide is built into two parts and here’s why: instead of going straight into the nitty gritty, we’ll first give you an overview of how you can find suitable loans to compare in the first place (spoiler: use a mortgage search engine!). After all, in order to do an effective comparison you’ll need the right products in front of you. Then, we’ll go through the small print and the various bits you need to look out for.

Table of Contents

Using a Mortgage Search Engine

When it comes to finding mortgages in the first place, we recommend using a mortgage search engine. These nifty tools trawl through all (well, most!) mortgage deals out there and churn them out in an easy-to-read format. The clear advantage is that you don’t have to do the initial heavy lifting yourself. Instead of sifting through the individual sites of dozens of banks, you can quickly assemble a digestible shortlist of products.

Which Engine Should You Use?

Each country has a leading search engine and it’s worth doing a little digging to ensure you’re working with a reliable website. After all, you’re very much at the mercy of their algorithms to find the best rate. These are some you may want to look at, depending on your location:

- Lendi (Australia). Focusing primarily on the Australian market, Lendi provides users with a fantastic tool here. What we like is that you can provide as little or as much information as you want. Go anonymous and get instant results, or chat to an expert to get handheld advice on which product best serves your individual circumstances.

- Uno (Australia). While not specifically an interest rate search engine Uno is a highly online mortgage brokerage service that can certainly help you to find the best deal.

- MoneySuperMarket (United Kingdom). MoneySuperMarket is Britain’s go-to website for financial searches, whether it’s credit cards, car insurance, or home loans. What is awesome about this tool is that it auto-updates every few minutes, meaning you’re really getting the best deal available right now.

- Zillow (United States). While the results that Zillow provides are great, the site is a little annoying to use. You have to answer a questionnaire and your details are given to a lender at the final stage. It’s not a ‘click and see all results’ solution, but their search algorithm is reliable.

- Finder (United States). While the results are a little easier to read and it’s nice to have them listed right from the get-go, Zillow is probably more accurate and provides superior search results. However, if you’re just looking for a snapshot of available lenders then Finder is a decent option.

Beyond the Interest Rate

Most people will use a mortgage search engine, list the product based on the lowest interest rate, and go from there. However, don’t just click on the “Apply” or “Get Approved” button just yet. Once you’ve narrowed down the number of products you’d like to consider, it’s time to do a deep-dive on each individual product.

Interest Rate vs Comparison Rate: Worked Example

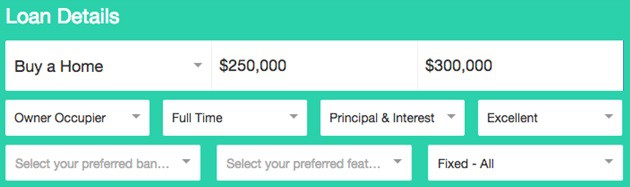

The main thing you need to understand is the difference between interest and comparison rates. We’ll run you through it using a worked example. We’re going to look for a home loan using our favourite Australian engine, Lendi. We’re looking for a $250,000 loan for a $300,000 home with the following settings:

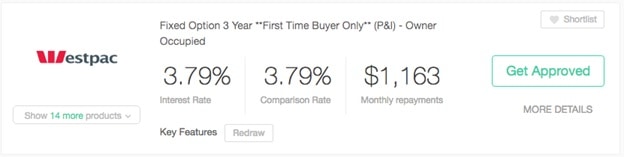

Based on this search, we get over 250 results. We’re going to order our results based on the lowest interest rate first. That gives us ING as the best-rated product:

Next, let’s order based on the lowest comparison rate. Now we have a different result in Westpac:

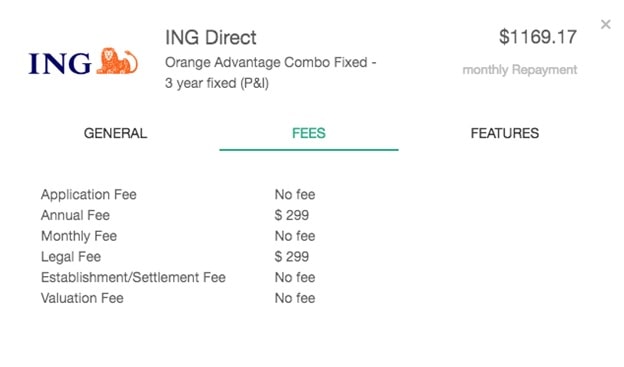

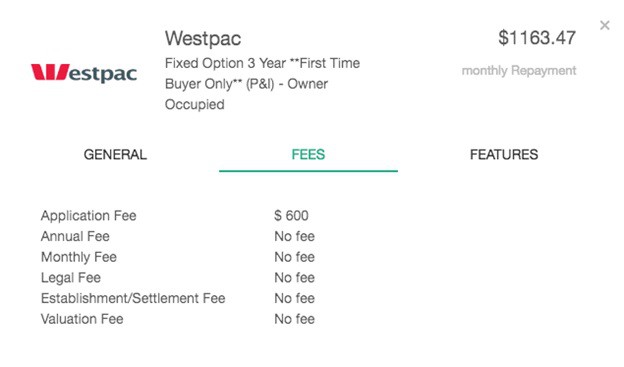

Let’s deep-dive into each product to explain the different rates. You can do this by clicking the “MORE DETAILS” link in the bottom-right of each product.

The key here is the annual fee that ING charges. Westpac, on the other hand, has an application fee of $600. ING doesn’t charge this, though it does have a $299 legal fee. The comparison rate, which banks are now legally required to advertise, is what you’ll really pay. You should always check the additional fees that banks may charge you.

So does this mean that Westpac is, by definition, the best product? Not necessarily. Let’s have a look at the small print at the bottom of the page, the ‘Important legal stuff’. This shows that the comparison rate is based on a loan of $150,000 over 25 years. You should therefore take the comparison rate as guidance only, especially if you’re planning on extra repayments (check out the in-depth extra repayments section below). This may make the savings you make on annual fees less relevant. Do your calculations based on your situation, not the sample one!

Additional Considerations

Principal and interest vs interest-only: We know what interest is, but what’s the principal? This is the amount borrowed. For the example above, it’s $250,000. There are some loans that are interest-only, which are suitable in only very specific conditions.

Variable interest rate: This means your interest rate can go up or down at a moment’s notice, all in line with the official cash rate.

Fixed interest rate: Many banks offer a fixed interest rate for a given time period. The longer this period, the higher the interest rate.

Split loan: Part of your loan can be fixed, with the other being variable.

The are other features, such as offset and redraw. The more features you want on your loan, the higher the interest (usually). ASIC’s MoneySmart gives a very good overview of these features.

Extra Repayments

The essential feature you’re looking for in a home loan is the ability to make extra repayments. The more, the better. Check the small print to make sure you won’t be paying hefty penalties for making them.

The standard mortgage runs for approximately 25 years. The view that a mortgage is ‘good debt’ is so entrenched in society (the argument whether that’s true is for another day!) that most people have absolutely no idea how much they’ll actually be paying the bank.

Worked Example:

Let’s say you’ve taken out a loan for $350,000, paying monthly at, for argument’s sake, an average interest rate of 6%. Guess how much you think you’ll have paid after the end of those 25 years. We’re willing to wager that the figures below will give you a wee shock.

Example Loan Size: $350,000

Example Interest Rate: 6%

Repayment Frequency: Monthly

Monthly Repayment: $2,255.05

Total Paid: $676,516.47

Yes, you’ll be paying almost twice as much as the original loan amount. Let’s consider how much you’d save with an additional $250 per month. Compared to the overall monthly repayment, it’s not exactly the big bucks.

Extra monthly repayments: $250

Start repayments at: 1 year

New monthly repayment: $2,505.05

Total paid: $609,106.32

Financial savings: $67,410.15

Time savings: 4 years, 8 months

We hope you’re starting to see our point here: even a small additional contribution can shave a significant amount of time and money off your loan. Let’s see if we can take that a little further.

Extra monthly repayments: $1,000

Start repayments at: 1 year

New monthly repayment: $3,255.05

Total paid: $517,121.77

Financial savings: $159,394.70

Time savings: 11 years, 5 months

With an additional $1,000 per month, you’re taking over a decade off your loan. The financial savings are enough to buy yourself a brand new holiday home (or boat, or your children’s tuition, or retirement fund, or whatever else takes your fancy!).

These figures are exactly why MTM recommends that 70% of your wage should go to your mortgage as per How Much Extra Should I Pay On My Mortgage. Yes, it’s difficult. But before you say it’s ridiculous and impossible, remember that many people already have done it and 70% is a target figure.

Let’s show you why this method can be so effective using our earlier example figures. Now let’s assume that you are living with your partner and you’re both earning the average wage for an Australian full-time worker:

| Jack’s Base Income: $70,000.00 | Jill’s Base Income: $70,000.00 |

| Jack’s Current HELP Debt: $0.00 | Jill’s Current HELP Debt: $0.00 |

| Jack’s Annual Tax: -$14,550.00 | Jill’s Annual Tax: -$14,550.00 |

| Jack’s Take Home Pay: $55,450.00 | Jill’s Take Home Pay: $55,450.00 |

Total Income After Taxes: $110,900.00

Based on the 70% rule, we’re going for a total monthly repayment of approximately $6,469. In terms of the earlier example of the $350,000 loan at 6% over 25 years, that works out to an additional repayment of $4,214 per month. Let’s have a look at the new figures:

Extra monthly repayments: $4,214

Start repayments at: 1 year

New monthly repayment: $6,469.05

Total paid: $427,642.12

Financial savings: $248,874.35

Time savings: 18 years, 10 months

Now we’re talking mortgage mutilation!

Based on a 70% repayment, you’re saving a ridiculous quarter of a million dollars and almost two decades. Now, how does this go back to the original question of interest rate comparisons? It goes back to the main point of this entire discussion: the interest rate does not tell the whole story.

Yes, it’s a crucial part but it’s not everything. In terms of repayments, you need to ensure the product you choose allows a healthy extra repayment figure. Some banks are very inflexible when it comes to this, charging ridiculous penalties when you go over the allowed repayments. So always remember, check the small print!

The benefits include: 1) How to pay off your mortgage faster than 99% of people with one hour a month of work 2) How to get rid of your debt and have the freedom to spend money on the things you love, guilt free 3) Clear outline of how to setup your expenses, mortgage and general finance 4) How offset accounts work and how to get the same result without being gouged by the big banks 5) How to cut through the crap and focus on the things that truly matter when taking down a mortgage 6) How to adjust the strategy so it works for you, even if you have kids, even if you only have one income 7) How to do all of these things and maintain a normal social life (and never be cheap).